ICICI Bank’s write-offs rose to ₹9,271 crore in FY25 from ₹6,091 crore in FY24

| Photo Credit:

DHIRAJ SINGH

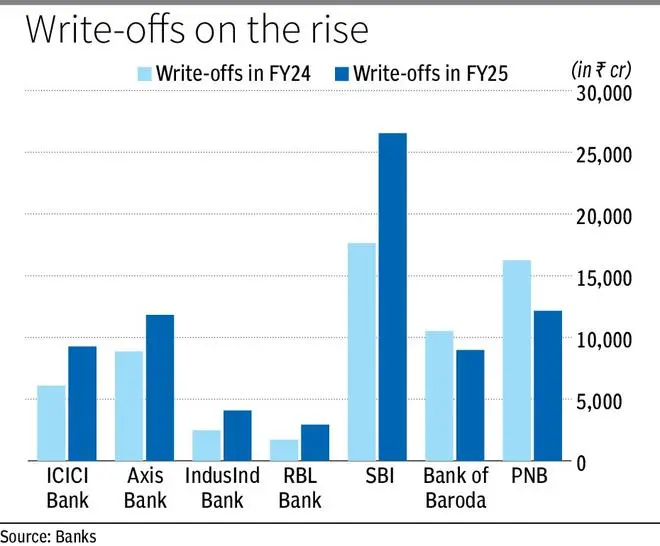

Banks, especially private sector lenders, have cleaned up their unsecured loan book aggressively in FY25, writing off A sharply higher amount of bad loans as against the previous fiscal.

Country’s largest lender, State Bank of India’s (SBI) write-offs rose to ₹26,542 crore in FY25 as against ₹17,645 crore in FY24. ICICI Bank’s write-offs rose to ₹9,271 crore in FY25 from ₹6,091 crore in FY24, while Axis Bank’s overall write-offs rose to ₹11,833 crore versus ₹8,865 crore in FY24. Similar trends were seen across multiple mid-sized private lenders, while public sector lenders fared better.

“Write-offs are mainly for the small-value loans. We regularly take stock. If provision coverage improves to 100%, we normally take them off the books and put them under advances under the collection account and hand the account to the recovery team. That is an ongoing process, broadly write-offs are coming from small value loans in SME and agriculture,” said CS Setty, Chairman, SBI.

Puneet Sharma, Axis Bank CFO, says the bank’s write-off approach is rule-based and it does not exercise any discretion on write-offs. “The program that we follow is after an account is provided fully, with elapsation of time, the account gets written off on our books…broadly given the environment, the write-off for the current quarter would have been on the retail, unsecured side.”

According to Hari Hara Mishra, CEO at Association of ARCs in India, recovery in written-off accounts has been around 20 per cent in the last three years, as per a reply in Parliament. In retail, however, he says it will be much lesser as there are consumer and personal loans without any security. Overall, recovery depends on customer profile, ageing of NPAs and availability of enforceable security, if any.

“On credit management, banks have four key stages. First, robust quality of underwriting at the stage of origination. Then, effective monitoring and follow-up ensuring no slippage from performing to non-performing. Third, once a loan turns NPA, efforts are made to upgrade it to standard to reverse incremental provisioning. And, finally, when despite all efforts if it has come to a stage where it had to been written off, one has to make a choice in continuing engagement with the accounts, with further costs and efforts or exits, through, say the arc route for available liquidity and redeployment of the monetisation proceeds, for potential higher returns,” he said.

To be sure, the RBI’s FSR report in December had highlighted that the sharp rise in write-offs, especially by private sector banks, could be partly masking worsening asset quality and dilution in underwriting standards, and is emerging as an area of concern.

Published on May 27, 2025