Global markets

Global stocks pulled back last week, likely reflecting some profit-taking after recent strong gains. But there are also concerns around US debt levels and Trump’s renewed tariff threats.

Market jitters return

The passing of a budget bill by the US House of Representatives mid-last week was not greeted by Wall Street with celebrations. The bill that passed would add around US$3-4 trillion to America’s debt burden over the coming decade. Bond yields leapt higher which, in turn, hurt stock markets.

The passing of tax cuts (or more correctly, the extension of existing tax cuts that were due to expire later this year) was not a surprise. Market uneasiness, however, surrounded the lack of any real offsetting budget cuts.

Instead, what has been agreed is a highly regressive cut to medical and food support for low-income households. These cuts may not be agreed to by Trump. What’s more, the bill also needs agreement from the US Senate. In the Senate, there are mixed signals about the need to increase budget savings. But there is also a desire to increase tax cuts and not hurt Medicaid (America’s healthcare program for low-income individuals and families).

How this plays out remains to be seen. Many are concerned that cuts to Medicaid and food stamps – apart from the cruel regressiveness – could cost votes in next year’s mid-term elections. All up, the budget squabble shows just how hard it is for the US to cut the deficit – unless a bond market revolt forces politicians’ hands. We got a brief taste of the potential for such a revolt last week, when US 10-year bond yields rose 0.11% on the day the House of Rep’s bill was passed. So far, the rise has been fairly modest. Not even Moody’s recent US credit downgrade caused a sustained ripple in bond markets.

Perhaps one factor helping to contain bond yields is the lingering risk of a US recession due to Trump’s erratic tariff policy. On Friday, Trump threatened a 50% tariff on the European Union due to stalled trade talks. In addition, he threatened a 25% tariff on any smart phone not made in the US. Equities finished flat while bond yields eased. There’s a sense markets are starting to look through his threats, knowing his bark is usually worse than his bite. For instance, reports hot off the press this morning suggest that Trump has agreed to delay the deadline for imposing his 50% tariff on the EU until July 9.

Former Trump staffer Anthony Scaramucci has called this the “TACO theory”. TACO stands for “Trump always chickens out!”

Global week ahead

Two key global highlights this week are the latest Fed meeting minutes and an update on inflation from the US private consumption deflator.

The Fed minutes may shed light on the balance of growth versus inflation concerns among voting members. But overall, the minutes should suggest the Fed remains cautiously on hold.

The core consumption deflator covers April and is not expected to contain much of a tariff impact. A benign 0.1% monthly increase is expected.

The Washington budget debate will also remain in focus. Namely, whether the Senate and/or Trump propose to add to or reduce the debt load that has been agreed to in the House of Representatives bill.

In New Zealand, the RBNZ is expected to cut rates by a further 0.25% to 3.25%. This reflects the decline in inflation back to the target band and higher than desired unemployment.

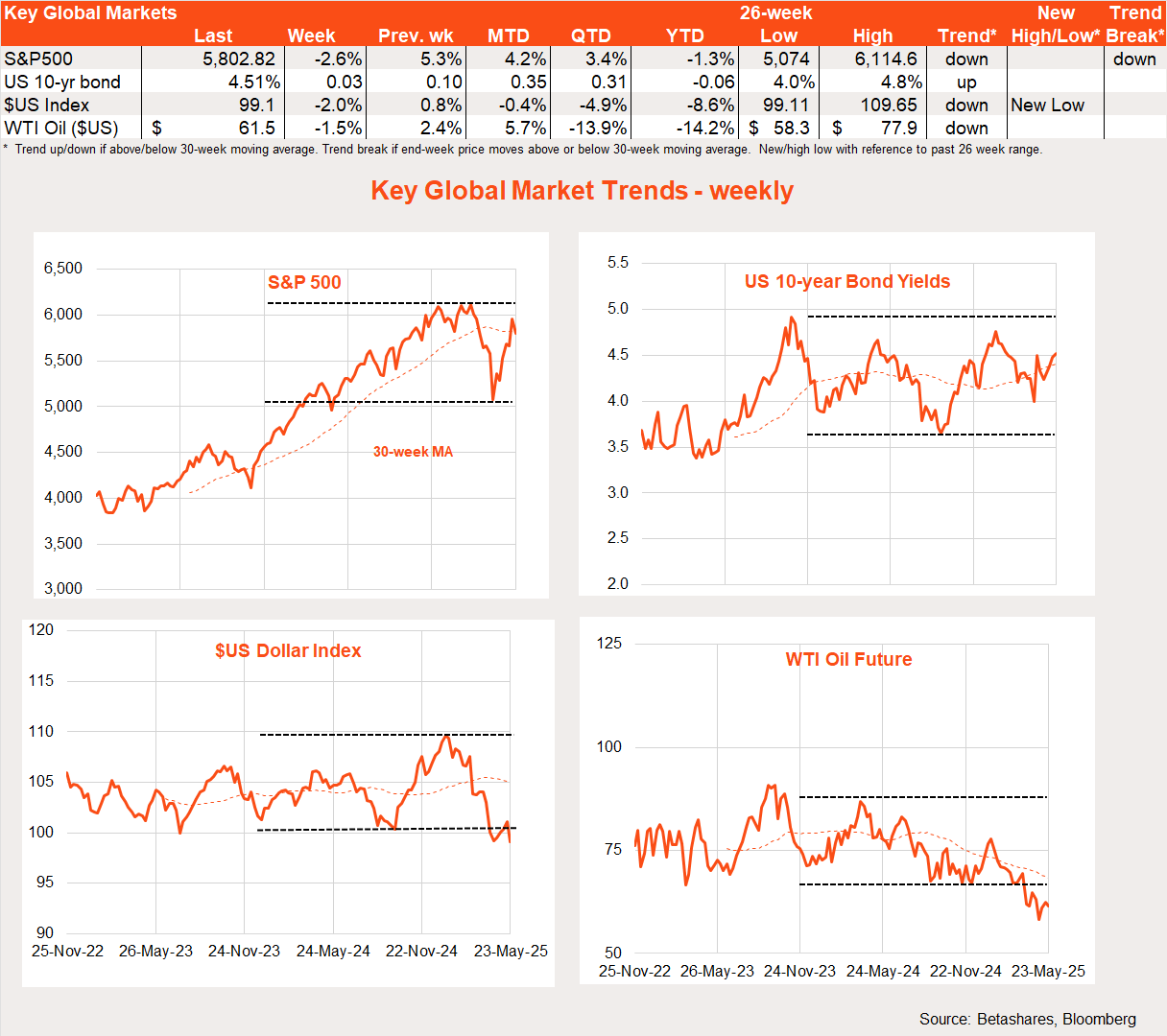

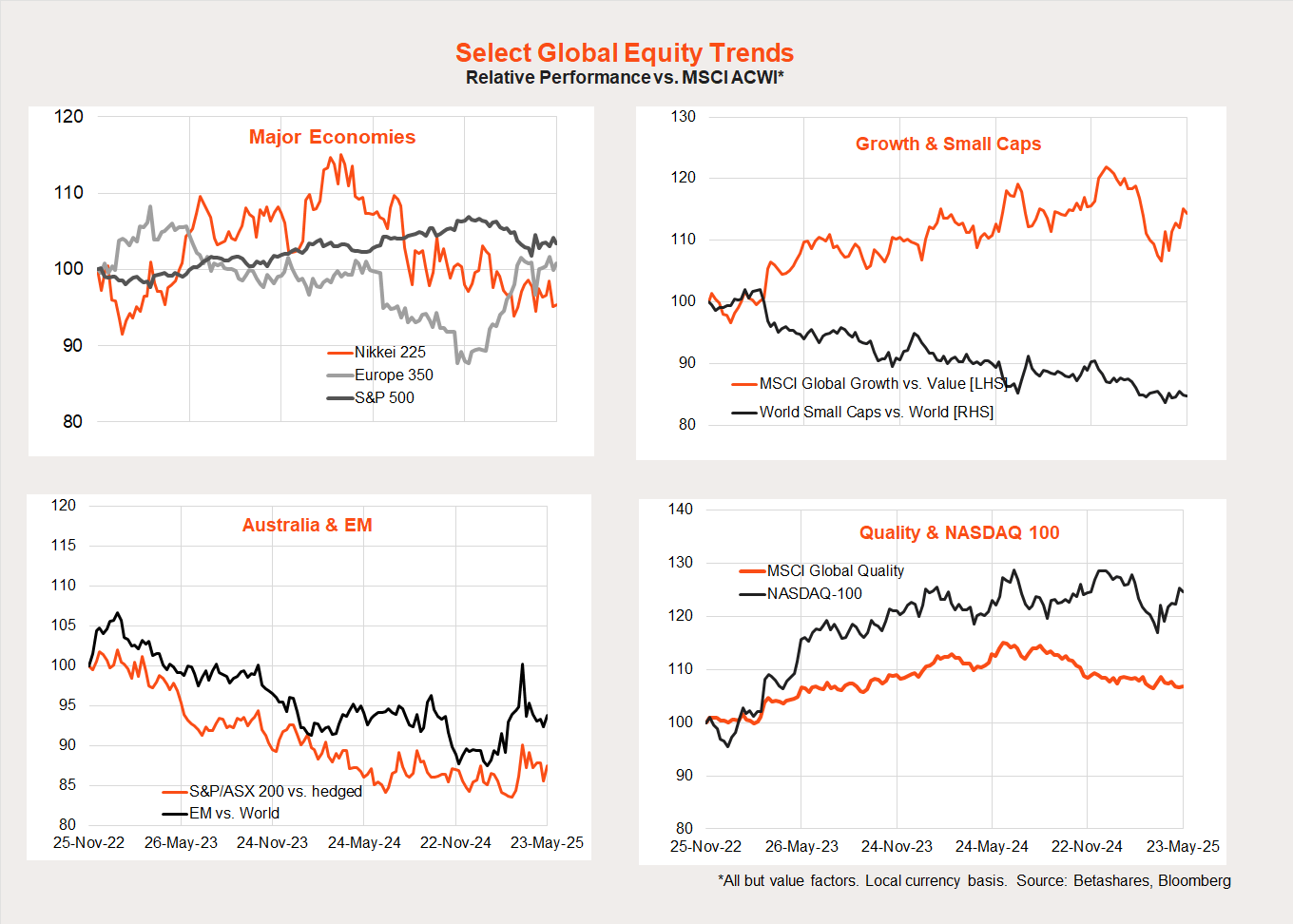

Global market trends

The recent bounce in global equities has also led to a rebound in the relative performance of growth over value, developed over emerging markets as well as the US relative to non-US markets.

These trends seem tied to equity market direction. If stocks resume their downtrend, I expect growth and US equity markets to be hit hardest. If, however, the equity uptrend has returned, reports of the death of US tech exceptionalism could be premature once again.

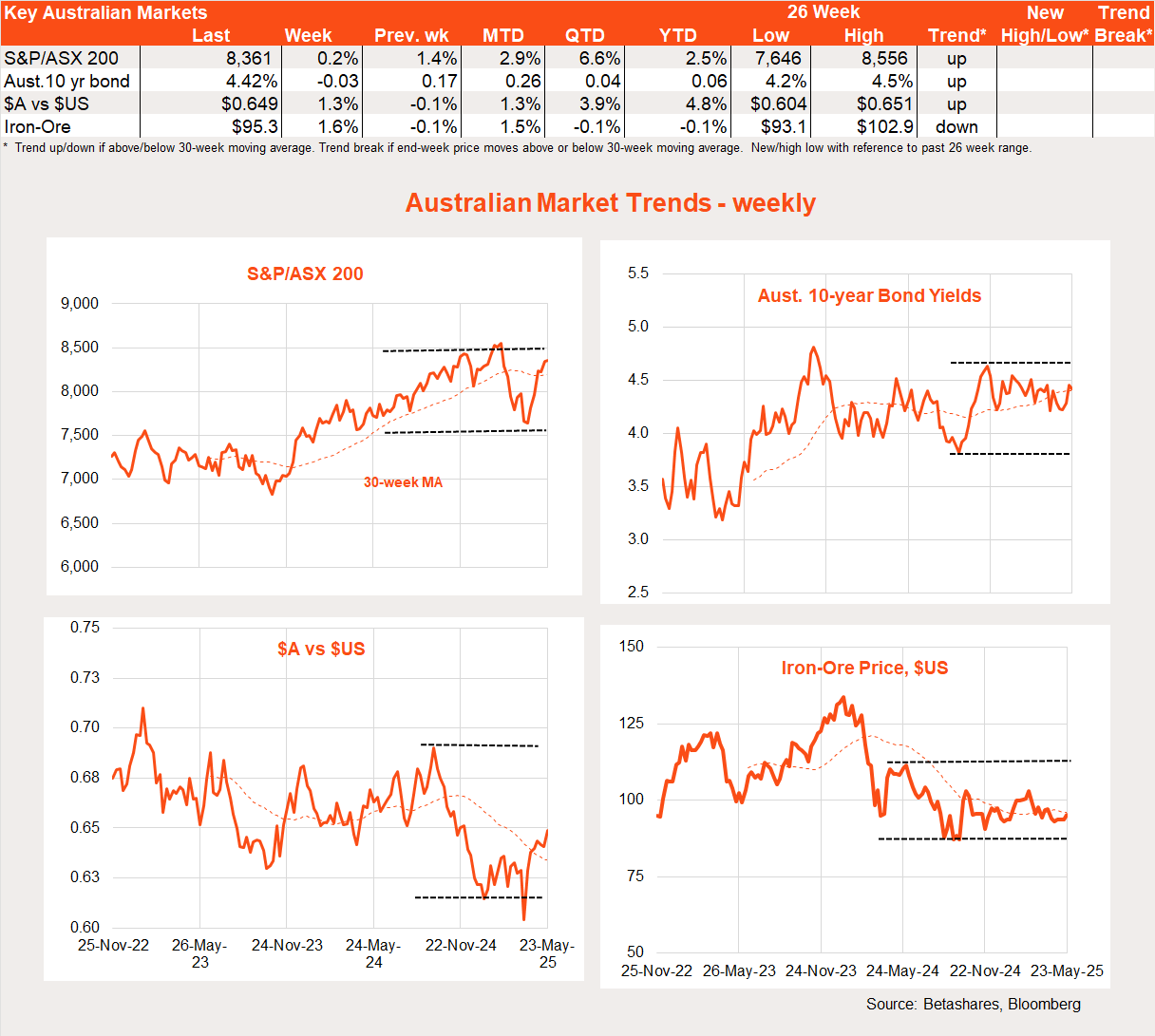

Australian markets

Local stocks bucked the weaker global trend last week. While they are yet to reflect Wall Street’s Friday drop, Trump’s weekend backdown on EU tariff increases will likely limit losses today.

Last week’s big news was the widely expected RBA rate cut.

While the RBA’s rate cut was not a surprise to the market, the relatively dovish tone of the associated commentary was a pleasant surprise. Importantly, RBA Governor Michele Bullock did not try to hose down expectations of further rate cuts this year. This was likely helped by renewed global trade tensions and a small lowering in the RBA’s inflation forecasts.

The RBA now expects underlying (trimmed mean) inflation to fall near the mid-point (2.6%) of the target range by the June quarter and stay there over the coming year. If so, there’s every reason to expect the Bank to continue to ‘re-normalise’ interest rates. This would mean lowering them from still-restrictive levels to a more neutral level (around 3%).

My base case is the RBA will cut rates by 0.25% after each of the next two quarterly CPI reports in August and November.

Turning to the week ahead, we get a monthly CPI update on Wednesday and a range of Q1 GDP building blocks covering business investment and construction.

Have a great week!