oatawa

By John Baldi, Michael Clarfeld, CFA & Peter Vanderlee, CFA

Dividend Growers Shine as Market Broadens

Market Overview

The market continued its strong run in the third quarter. The S&P 500 Index (SP500,SPX) increased 5.89% in the quarter and is now up 22.08% year to date. The ClearBridge Dividend Strategy (MUTF:SOPAX) outperformed the S&P 500 benchmark as returns broadened out and the information technology sector, the driver of returns in the first half of the year, lagged. Both sector allocation and stock selection contributed to outperformance in the quarter as our diversification and valuation discipline were rewarded.

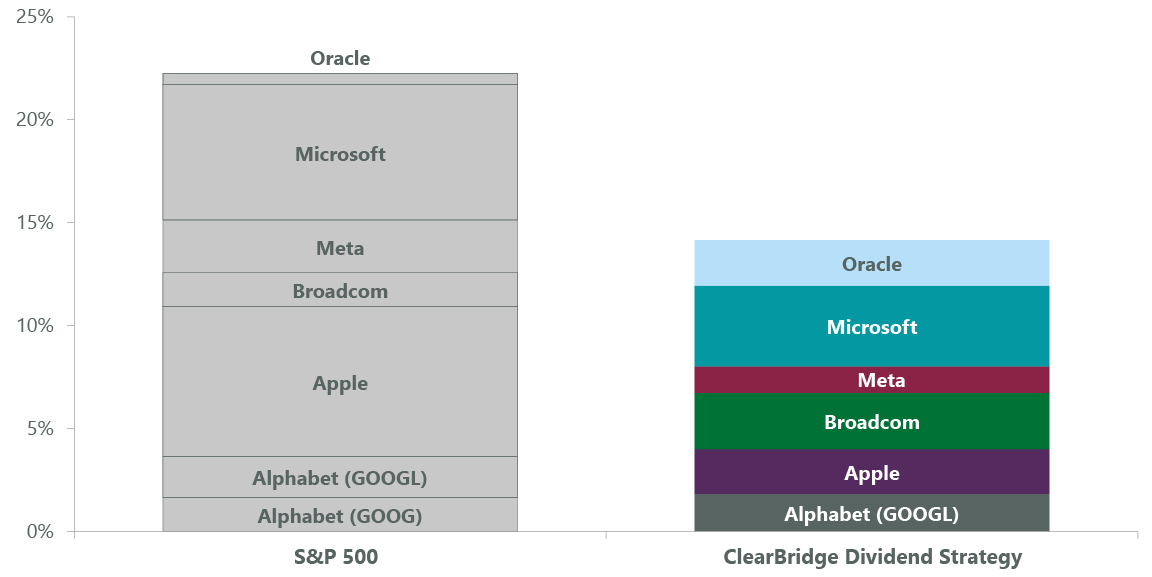

While AI continues to dominate the headlines and investor focus, AI stocks took a breather in the quarter. Over the last 18 months these equities have collectively added trillions of dollars to their market cap, but, apart from Nvidia (NVDA), have yet to deliver the earnings growth required to support their stock prices. We are not suggesting that AI will disappoint – only time will tell – but these stocks clearly now embed significant value from AI. Our holdings in Alphabet (GOOG,GOOGL), Apple (AAPL), Broadcom (AVGO), Meta Platforms (META), Microsoft (MSFT) and Oracle (ORCL) are all well-positioned to benefit from growth in AI. However, because of our disciplined approach to valuation and our conservative approach to portfolio construction, we have lower exposure to these names than the S&P 500 (Exhibit 1).

Of course, the other big news for investors in the quarter was the Federal Reserve’s half-point rate cut. As it became clear during the summer that the Fed was poised to cut rates, interest-rate-sensitive sectors like housing, pipelines, real estate and utilities outperformed.

Exhibit 1: A Disciplined Approach to AI

As of Sept. 30, 2024. Source: FactSet, MSCI.

Our overweight in these areas all benefited from the salutary impact of lower interest rates on sectors that employ meaningful amounts of debt. Our stocks also benefited from company-specific drivers. AvalonBay Communities (AVB), a best-in-class apartment REIT, benefited from sustained healthy rent growth. Several large private equity firms, like Blackstone (BX), have recently acquired large apartment portfolios, shining a light on the attractiveness of the space. During the quarter Enbridge (ENB) closed the final piece of its utility acquisition and wound down its at-the-market equity issuance program, indicating to investors that Enbridge can deliver on its compelling long-term growth strategy without issuing dilutive equity. Over the last two years American Tower (AMT) shares languished as investors worried about the earnings impact from refinancing debt at higher rates. Now that rates have declined, the headwind is lessened and the shares have lifted. Edison International (EIX) reached a tentative deal to recoup $1.7 billion in wildfire and mudslide expenses in California, bolstering its balance sheet, increasing earnings and demonstrating the supportiveness of California’s regulatory environment.

“With trillions of dollars of AI expectations now embedded in these securities, these winners are more expensive and offer less upside.”

While our IT positioning drove the bulk of the Strategy’s outperformance in the quarter, the main detractor also came from the sector. Intel (INTC) reported results and gave profitability guidance materially below consensus. While we are intrigued by its efforts to regain its one-time leadership in semiconductor manufacturing, Intel’s turnaround is taking longer than we had hoped, and with the suspension of its dividend beginning in the fourth quarter, we elected to exit our position and seek better opportunities elsewhere.

Outlook

While the Federal Reserve was slow to respond to inflation in 2021 and 2022, they ultimately moved aggressively and brought inflation to heel. They have done this without triggering a recession and it seems the economy is headed for a soft landing. China has recently taken significant steps to juice its economy, and that too should help to put a floor under the global outlook.

The U.S. election is a month away, and it will clearly be consequential for the economy and society. At this point, it is a toss-up. While the two candidates represent very different approaches, we do not see obvious ways for equity investors to position themselves ahead of the election.

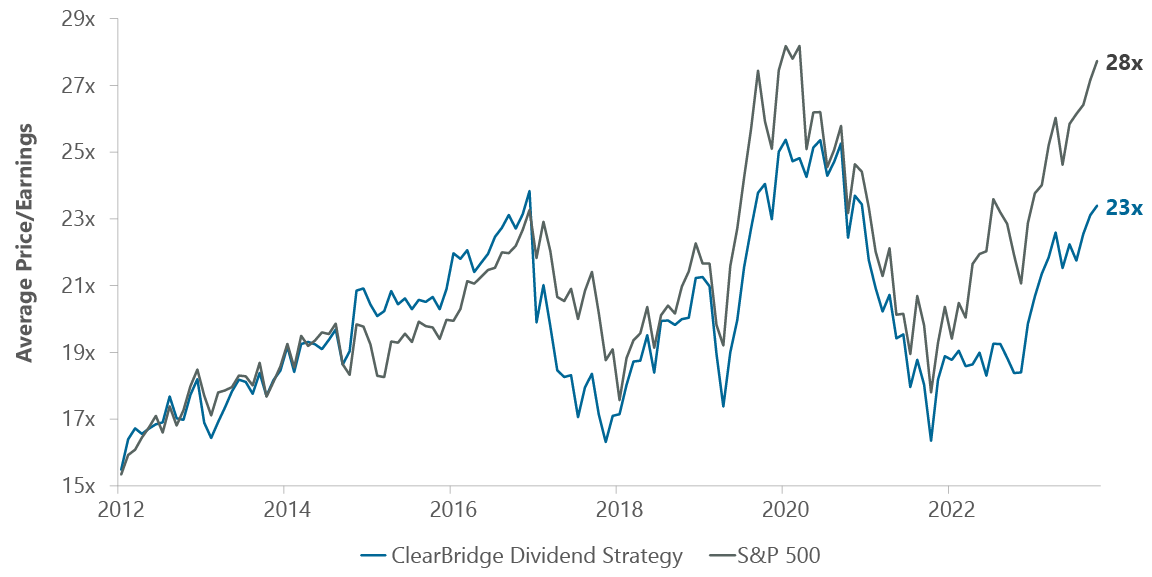

We like our portfolio and are optimistic about our positioning. While high-quality dividend growers have done well over the long term, they have lagged the S&P 500 over the last 18 months due to the index’s intense concentration in a handful of technology names which have benefited from AI enthusiasm. With trillions of dollars of AI expectations now embedded in these securities, these winners are more expensive and offer less upside. Recent concentration has caused our differentiated portfolio to currently trade at a meaningful discount to the broader market (Exhibit 2).

Exhibit 2: Dividend Strategy Trades at a Meaningful Discount to the Market

As of Sept. 30, 2024. Source: ClearBridge Investments, FactSet.

The significant decline in long-term interest rates increases the relative attractiveness of the yields available in our high-quality dividend payers (Exhibit 3). Investors began to gravitate back toward such stocks in the third quarter, and we suspect we will see more of that.

Exhibit 3: Dividend Growers Poised for Outperformance

| *Dividend Growers are S&P 500 stocks with three consecutive trailing years of positive dividend growth (inclusive of special dividends) on a rolling basis (quarterly), evaluated monthly, equal weighted. As of Sept. 30, 2024. Source: S&P, NBER, Bloomberg. |

Portfolio Highlights

The ClearBridge Dividend Strategy outperformed its S&P 500 Index benchmark during the third quarter. On an absolute basis, the Strategy saw positive contributions from all 11 sectors in which it was invested for the quarter. The financials and consumer staples sectors were the main positive contributors.

On a relative basis, stock selection and sector allocation contributed to outperformance. In particular, stock selection in the energy, IT, communication services and consumer staples sectors, an underweight to the IT sector and overweights to the utilities, real estate, materials, financials and consumer staples sectors aided relative results. Conversely, stock selection in the financials, utilities and materials sectors and an overweight to the energy sector detracted.

On an individual stock basis, the main positive contributors were Oracle, Enbridge, T-Mobile (TMUS), Travelers (TRV) and RTX. Positions in Intel, Merck (MRK), Microsoft, Alphabet and Waste Management (WM) were the main detractors from absolute returns in the quarter.

John Baldi, Managing Director, Portfolio Manager

Michael Clarfeld, CFA, Managing Director, Portfolio Manager

Peter Vanderlee, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.