#geopolitics

#risk

President Donald Trump issued a direct threat to Iran, saying he’d hold the regime responsible for future attacks on shipping in the Suez Canal and southern Red Sea by Houthi rebels. His threat of retaliation against Tehran ratchets up the stakes even more after he authorized military strikes over the weekend on the group. The Houthi health ministry said 53 people were killed.

Successive US administrations have accused Iran of supplying training, expertise and weapons to the Houthis, but taking on Iran directly would carry a fresh set of risks. Trump’s director of national intelligence, Tulsi Gabbard, said that other countries should follow the US lead and take more decisive action against the Houthi militia, which had vowed more attacks on shipping if more aid doesn’t reach Gaza.

— Kevin Whitelaw

What You Need to Know Today

Russian President Vladimir Putin and Trump are due to speak tomorrow, the Kremlin confirmed, as Europe watches nervously to see what the conversation might mean for Ukraine. Putin has said he’s willing to consider a truce in principle, but has insisted on a number of conditions before he’ll commit to any halt to the invasion he started three years ago. That call is scheduled for a symbolic day for Putin, since he’s declared it the annual celebration of Russia’s “reunification” with Crimea to mark the 2014 annexation of Ukraine’s Black Sea peninsula. “We’ll be talking about land,” he told reporters over the weekend.

Canada’s new prime minister wasted no time in courting European allies as the country urgently is trying to reduce its dependencies on the US under an antagonistic Trump administration. Mark Carney stood next to French Pesident Emmanuel Macron in Paris to say the country must deepen its trade and security ties with the democratic nations of Europe. The former central banker is expected to call an election in Canada in the coming days, but made a point of first going to Europe for a diplomatic showcase rather than visit Washington.

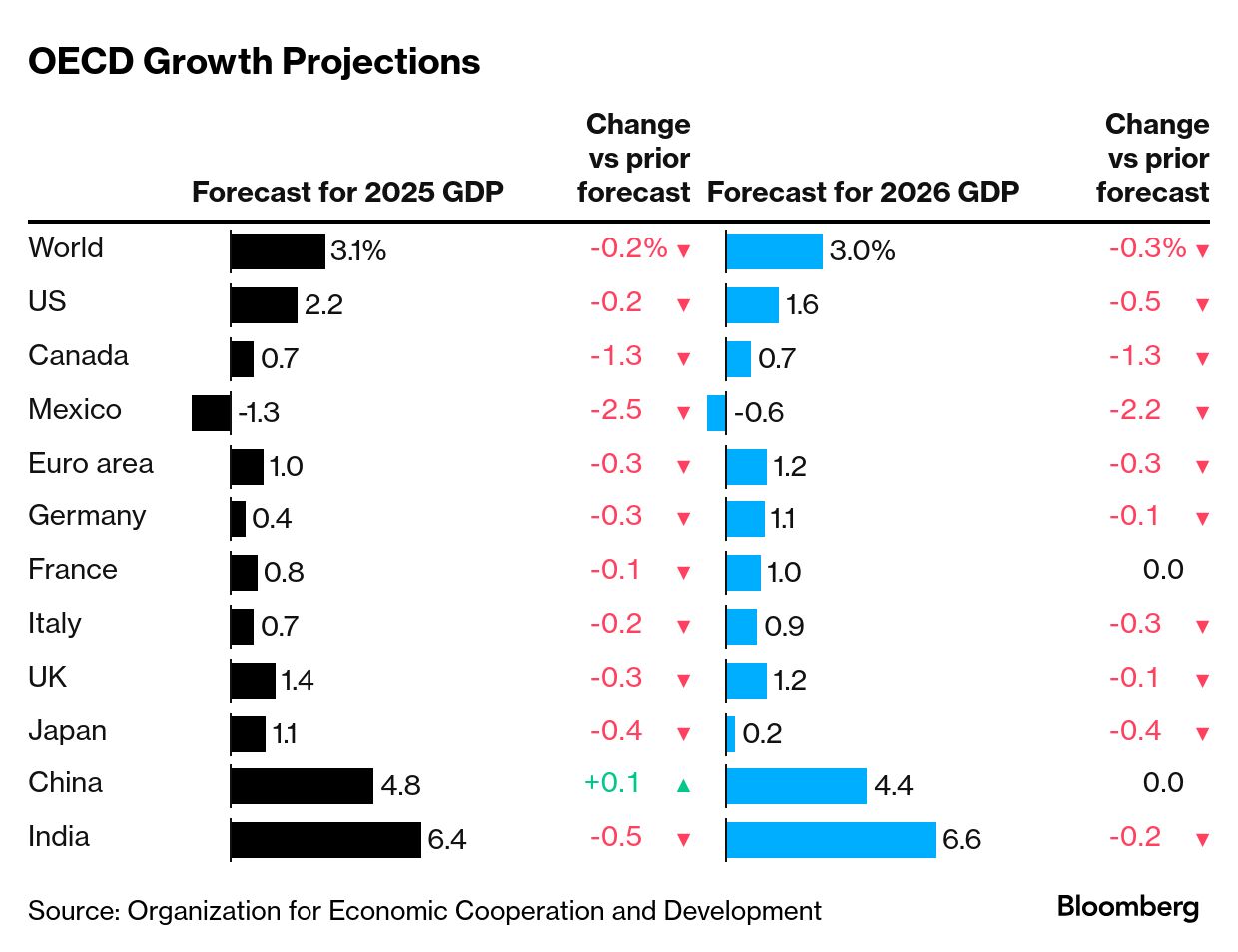

The world economy is suddenly on a slower growth path thanks to the shock of Trump’s aggressive trade policies. The OECD cut its outlook for most members and predicted the pace of global expansion to slow to 3.1% this year and 3% in 2026 as barriers restrain commerce and surging uncertainty holds back business investment and consumer spending. The impact could be sharpest in those countries at the center of the storm like Canada and Mexico.

Pension funds in northern Europe are currently reviewing new mandates from the Trump administration amid concerns that US funds will ignore climate risks. In London, meanwhile, lawyers advising hedge funds say their clients are dropping oil exclusions in order to hold on to US clients. It’s a split-screen moment which has fund managers struggling to strike the right balance as they adjust to the divergent paths of the US and Europe.

With Europe ramping up its defense spending, its biggest missile maker MBDA plans to spend as much as €2.5 billion ($2.7 billion) and go on a hiring spree. The company — a venture between France’s Airbus, BAE Systems from the UK and Leonardo of Italy — boasts an order backlog of €37 billion after the intake reached an all-time high of €13.4 billion last year, according to CEO Eric Beranger.

German defense firm Rheinmetall, meanwhile, is on track to potentially replace French luxury conglomerate Kering in the blue-chip Euro Stoxx 50 benchmark via a fast-entry addition in June, according to UBS. The massive surge in Rheinmetall shares this year, propelled by the expectation of more military spending, means that the company currently ranks number 26 on UBS’s predicted Stoxx 50 selection list. It would need to outperform the current 25th-ranked stock, ING, by around 1% in the next couple of months to qualify for fast entry. Tomorrow, Germany holds a pivotal first vote on a plan to allow billions more in public spending.

The Irish costal town of Kinsale is booming, thanks to an Eli Lilly factory that produces an active ingredient for its blockbuster Mounjaro and Zepbound drugs. But the 1,200-employee facility of the US pharma giant is the kind of development that Trump says the US shouldn’t have allowed to happen. With Ireland — and its outsize trade surplus with the US — feeling extra exposed to Trump’s tariffs threats, Dublin mounted a St. Patrick’s Day diplomatic offensive.