Filing taxes can be confusing, especially when living or doing business in a foreign country. If you’re residing or operating in Saudi Arabia, understanding how the tax system works is crucial for avoiding legal trouble and staying compliant.

You might be wondering if income tax applies to you, what your responsibilities are, or whether any exemptions apply. This guide is designed to answer all your questions about income tax filing in Saudi Arabia, particularly in a landscape where personal income taxes don’t operate the same way as in many other countries.

Whether you’re an expat, a business owner, or simply curious about Saudi tax laws, this article breaks down the essentials in a clear and practical way.

With a growing business sector and evolving regulatory environment, knowing what’s expected can help you avoid penalties and make informed financial decisions in the Kingdom.

What Are the Basics of Income Tax Filing in Saudi Arabia?

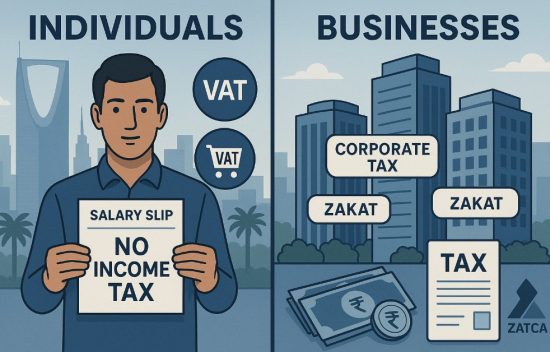

Saudi Arabia stands out for having no personal income tax on salaries and wages. This means individuals, whether residents or expats, typically do not need to file income tax returns for employment earnings.

However, that doesn’t mean the country is tax-free. Instead, the system is centered on other forms of taxation like corporate tax, VAT, and zakat.

The authority overseeing taxation in Saudi Arabia is the Zakat, Tax and Customs Authority (ZATCA), formerly known as GAZT. ZATCA manages tax compliance, assesses tax liabilities, and ensures businesses adhere to filing deadlines and rules.

While employees may not have to worry about tax returns, businesses operating in the Kingdom must file and report various tax obligations, depending on their ownership structure and revenue sources.

For instance, foreign-owned entities are generally subject to income tax, while Saudi-owned entities are typically subject to zakat, an Islamic contribution based on net worth.

Who Needs to File Income Taxes in Saudi Arabia?

Though individuals are not subject to income tax on personal salaries, some people and entities are still required to file taxes in Saudi Arabia. Primarily, businesses with foreign ownership, mixed partnerships, and certain investors must file corporate income tax returns.

If you are a non-resident with income derived from Saudi sources, such as service contracts or investments, you may be subject to withholding tax. This requires filing through an authorized representative or the ZATCA portal.

Freelancers or self-employed individuals who earn money through international platforms are typically not taxed in Saudi Arabia, but they should still keep clear records in case of future regulatory changes.

Tax residency does not apply to individuals for personal income tax purposes, but companies registered or operating in the Kingdom are automatically subject to Saudi tax regulations depending on their structure. Understanding whether you fall under corporate, mixed, or foreign ownership is key to determining your tax filing responsibilities.

What Taxes Are Imposed on Individuals and Businesses?

The Saudi tax system primarily targets businesses rather than individuals. Here’s a breakdown of the types of taxes that may apply:

- Zakat: Applicable to Saudi-owned companies or GCC-owned businesses. It is based on the net worth of the entity and calculated as a religious obligation rather than a traditional tax.

- Corporate Income Tax: Imposed on non-Saudi or foreign shareholders in a business, typically at a flat rate of 20 percent on net income.

- Withholding Tax: Charged on certain cross-border transactions made to non-resident parties. Rates vary depending on the type of payment and treaty agreements.

- Value-Added Tax (VAT): A 15 percent tax applicable to the sale of goods and services. It affects both businesses and consumers.

Individuals with only employment income are generally exempt from tax filings. However, foreign contractors, business owners, and investors must ensure compliance with corporate or withholding tax obligations.

How Does the Tax Filing Process Work in Saudi Arabia?

The tax filing process in Saudi Arabia is managed through the ZATCA (Zakat, Tax and Customs Authority) online portal. Here’s how the typical process works:

Filing taxes includes several key steps:

- Registering your business or entity with ZATCA

- Accessing the online portal for tax services

- Preparing financial statements and documentation

- Calculating zakat or corporate tax liability based on ownership and revenue

- Submitting your tax return before the designated deadline

- Paying any applicable taxes or zakat via approved channels

Filing deadlines depend on your company’s fiscal year. ZATCA usually requires filing within 120 days of the end of the financial year.

The online platform simplifies submissions and offers resources to help businesses meet their obligations. Using a certified accountant or tax advisor is highly recommended, especially for foreign-owned entities or mixed ownership companies that must calculate both zakat and tax.

How Does Withholding Tax Apply in Saudi Arabia?

Withholding tax is a key part of Saudi Arabia’s tax system, particularly for non-resident service providers and investors. It’s applicable when payments are made to non-resident parties from a Saudi source.

Common situations where withholding tax applies:

- Technical service payments to foreign consultants

- Royalties, interest, or dividends to non-residents

- Rent or lease payments for equipment used by foreign entities

- Management fees to parent companies abroad

The standard withholding tax rates range from 5 percent to 20 percent depending on the nature of the transaction.

For example:

- 5% on dividends and interest

- 15% on management fees

- 20% on other types of payments not covered by treaties

Treaty agreements between Saudi Arabia and other countries may offer reduced rates. Businesses are responsible for deducting the tax and submitting it to ZATCA within ten days of the payment.

Are There Any Tax Benefits or Exemptions for Expats?

Yes, expats in Saudi Arabia enjoy certain tax advantages. Most notably, personal income earned from employment is not subject to tax, regardless of residency or nationality.

Here are the key benefits for expats:

- No personal income tax on wages or salaries

- No capital gains tax on personal investments

- No inheritance or estate taxes

- Exemptions from zakat, which is only applicable to Saudi/GCC entities

However, foreign-owned businesses and expat investors must still comply with corporate tax or withholding tax rules. It’s also important to check whether your home country requires you to declare foreign income.

Although tax filing isn’t required for employment income, expats running a business or providing paid services in Saudi Arabia should register with ZATCA and understand applicable obligations. Staying compliant helps you avoid penalties and keeps your legal status secure in the Kingdom.

What Happens if You Don’t File Taxes Correctly in Saudi Arabia?

Failure to comply with Saudi Arabia’s tax laws can lead to significant financial and legal consequences. The Zakat, Tax and Customs Authority (ZATCA) actively monitors compliance and enforces penalties for delays, underreporting, or non-filing.

If a business fails to submit returns on time, it may face fines of up to SAR 25,000, depending on the type and frequency of the violation. Inaccurate filings can lead to additional penalties of 1 percent for every 30 days the error remains uncorrected.

ZATCA also imposes late payment interest and may take legal action, such as freezing accounts or suspending business operations, in cases of ongoing non-compliance. These measures are in place to maintain financial transparency and fairness in the system.

Whether you’re a company owner or a representative of a foreign entity, adhering to deadlines and maintaining accurate records is critical to avoiding these penalties and preserving your business reputation.

How Can Businesses Stay Compliant With Saudi Tax Laws?

To remain compliant, businesses in Saudi Arabia must understand their tax category and fulfill all reporting and payment obligations accurately and on time. This begins with correct registration through the ZATCA platform and continues through regular audits and filings.

Hiring a local accountant or tax advisor familiar with Saudi regulations can prevent costly mistakes. They can help determine whether zakat or corporate income tax applies, handle documentation, and ensure payments are made within the legal timeframe.

Regular financial audits, timely VAT reporting, and withholding tax deductions are all necessary practices for businesses. ZATCA periodically updates tax laws, so staying informed about regulatory changes is also key to avoiding penalties.

Companies should keep digital and hard copies of financial records for at least 10 years. This not only supports legal compliance but also prepares your business for future growth and investment opportunities in the region.

Conclusion

Understanding the tax filing system in Saudi Arabia isn’t just about avoiding penalties—it’s about empowering yourself with knowledge to make confident financial and business decisions. While individuals are exempt from personal income tax, business owners and foreign investors must navigate a system that includes zakat, corporate tax, VAT, and withholding tax.

With regulations evolving and ZATCA increasing enforcement, staying informed is more important than ever. Whether you’re an expat planning to open a business or a corporate entity managing international transactions, knowing your obligations can save time, money, and legal trouble.

By familiarizing yourself with Saudi Arabia’s tax structure and using professional support when needed, you can stay ahead of deadlines and remain fully compliant in a competitive and growing economy.

FAQs

Do expats in Saudi Arabia pay personal income tax?

No, expats do not pay personal income tax on their employment income in Saudi Arabia. The country does not impose income tax on salaries or wages for individuals.

What is the difference between zakat and income tax in Saudi Arabia?

Zakat is a religious levy on net worth applicable to Saudi and GCC-owned companies. Income tax applies to foreign-owned businesses and is calculated on net income.

How do I file a withholding tax return in Saudi Arabia?

Withholding tax returns are submitted through the ZATCA online portal. The entity making the payment must deduct the tax and file the return within 10 days of the transaction.

Is there a deadline for tax return submissions in Saudi Arabia?

Yes, tax returns must be submitted within 120 days of the end of a company’s financial year. Delays can result in penalties.

Are freelancers taxed in Saudi Arabia?

Freelancers are generally not subject to income tax unless operating as a registered business. However, it’s advisable to track income and stay informed of regulatory updates.

What documents are required for income tax filing?

Required documents typically include financial statements, revenue reports, withholding certificates (if applicable), and company registration details.

Can non-residents be taxed in Saudi Arabia?

Yes, non-residents earning income from Saudi sources may be subject to withholding tax. The payer is responsible for deducting and remitting the tax.