Sometimes, even a tech darling can fall out of favor with investors—especially when growth stalls, risks mount, and headlines shift to shinier trends. Yet underneath the noise, some companies still quietly deliver the essentials of dividend growth. Let’s take a look under the hood.

Built for Ecosystem Domination

This business has become synonymous with sleek design, intuitive software, and a locked-in user base. It makes its money selling a mix of high-end hardware and subscription-based services that are deeply integrated into users’ daily lives.

From smartphones to wearables, from digital content to payment systems, it has created an end-to-end experience that keeps customers loyal. The hardware draws you in, the services make you stay—and the margins come from both.

Its silicon strategy (custom chips for performance and battery life) and platform control (think App Store and Apple Pay) make it more than a product company. It’s a fully enclosed ecosystem that just so happens to pay you a dividend.

Services Spotlight: Where Growth Hides

Apple’s growth story may no longer center on iPhone unit sales, but its Services segment is slowly becoming the crown jewel of the empire. From iCloud and AppleCare to its App Store and bundled media offerings (Apple One), Services generated over $26B in quarterly revenue—good for a record high and 12% YoY growth. This segment commands gross margins above 70%, far outpacing hardware, and provides Apple with predictability investors love.

The integration of “Apple Intelligence” into native apps like Mail, Messages, and Siri could further boost stickiness across subscriptions. Whether it’s Fitness+, News+, Music, or iCloud+, Apple’s ecosystem has become a digital tollbooth—small recurring fees that add up to a mountain of cash flow. In a world where device growth is slowing, this shift toward monetizing its massive user base is a textbook example of reinvention.

When Growth Slows, Is the Core Still Strong?

Bull Case: Monetizing the Base

Apple remains one of the most valuable companies in the world, and for good reason. The shift from hardware growth to service monetization is well underway. Services now account for over 25% of revenue and continue to grow in the double digits.

Its latest “Apple Intelligence” push is designed to keep users engaged—and upgrading—while enhancing the functionality of older models like the iPhone 16e. Growth in India and Southeast Asia also means the user base is still expanding.

Meanwhile, tight integration between hardware and software boosts margins. And don’t forget: this is a cash machine with an ecosystem moat wider than most.

Bear Case: Too Big to Sprint?

There’s no denying Apple is under pressure. iPhone sales still make up over 50% of revenue—leaving it vulnerable to market saturation, geopolitical tensions (China + Taiwan), and regulation aimed at breaking its ecosystem grip.

Wearables have cooled off. AI innovation is stronger at Microsoft and Google. And the Vision Pro may be more “early tech demo” than “iPhone moment.” In Mike’s words: “It’s been a few years since Apple delivered that high single to double-digit growth investors came to expect.”

Want to Build a Dividend Income Stream for Life?

The Dividend Income for Life Guide shows you how to generate safe, growing income—year after year. Whether you’re just getting started or fine-tuning your portfolio, this guide walks you through proven strategies and timeless principles.

Get your copy here

What’s New: iPhone Sales Steady, Services Shine

Recent quarterly results (May 2025) beat expectations, but the growth story is increasingly uneven:

-

Revenue: +5% YoY

-

EPS: +8% YoY

-

Services: Record $26.65B, up 12%

-

iPhone: +2% YoY, helped by iPhone 16e

-

Mac: +7%, iPad: +15%

-

Wearables & Home: -5%, showing softness in saturation

While Services delivered a record-breaking quarter, Apple’s wearables segment is cooling off, and the spotlight remains on AI and innovation—two areas where competitors are gaining ground.

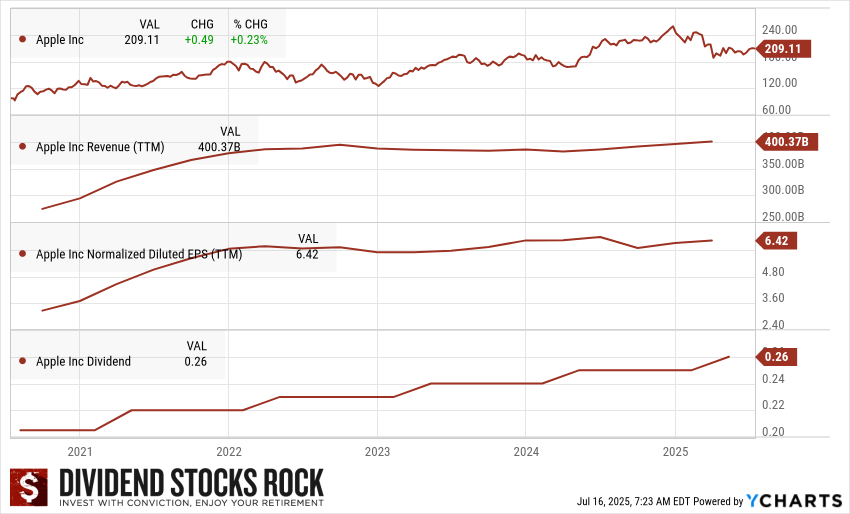

The Dividend Triangle in Action: Modest but Reliable

Let’s break it down across our Dividend Triangle:

-

Revenue Growth: Now back above $400B annually, though growth is slowing.

-

Earnings Growth: EPS sits at $6.42, up slightly from last year.

-

Dividend Growth: Recent increase to $0.26/share, with consistent low-single-digit hikes.

The yield remains low, but the payout is safe and growing. Apple prefers to return value through buybacks—but the dividend trend remains intact.

Final Words: Quiet Power, Loud Headlines

This isn’t a screaming buy or a high-yielder. But if you want stability, predictability, and a cash-rich business with a history of rewarding shareholders—it still deserves a spot on your watchlist.

The market’s focus on AI disruption, regulation, and China risks may keep sentiment muted. But that’s sometimes when a reliable compounder quietly does its best work.

The Best Guide to Creating a Sustainable Dividend Income at Retirement

This guide is for any investor who wants to create a sustainable income from his/her portfolio. It will be useful during your accumulation phase as you will avoid major mistakes and build a solid portfolio for your retirement. It will be even more useful if you are retired and count on your portfolio to pay the bills.

We all invest with the same goal: having our money working for us.