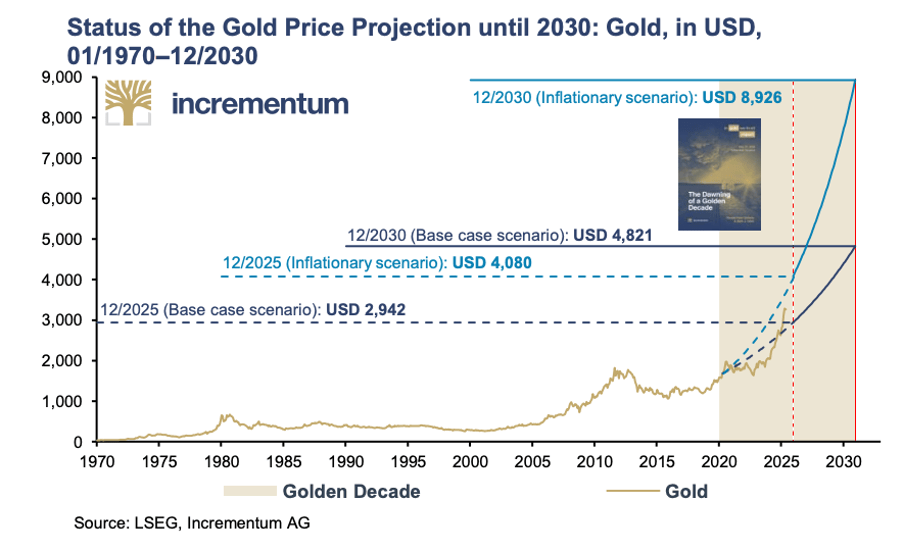

- International asset manager Incrementum has forecast the gold price to reach US$4,821 by 2030 under its likely base case scenario

- An inflationary tail risk outlook in Incrementum’s analysis has the price at a whopping US$8,926 by the end of the decade and US$2,942 this December

- Nova Minerals is stepping up efforts to meet the supply deficit at its Estelle project, one of the largest undeveloped gold projects in a tier-1 location

Special Report: International asset manager Incrementum has forecast gold to hit US$4,821 an ounce by the end of the decade. And that’s just the base case. Goldies such as Nova Minerals are set to benefit.

‘Where are you going, gold?’ asks asset manager Incrementum in its latest In Gold We Trust report.

The answer, delivered within the analytical dive into the gold market, is a long way from the current price. Incrementum’s likely base-case scenario puts the yellow metal at US$4,821 (~A$7,500) an ounce by December 2030.

Looking at the shorter term, report co-author Ronald-Peter Stöferle has gold at roughly US$2,942 (A$4572) per ounce by the end of this year. It’s already trading above that at the time of writing (see further below).

But according to the report, there’s also a scenario that lifts gold to US$8,926 (A$13,886) by the end of this decade and US$4,080 (A$6,347) by December this year.

The report’s authors note the likelihood of this depends mainly on how inflationary the next five years will be.

Whatever scenario eventuates, the report argues the market has witnessed a “paradigm shift” in recent quarters, with historical comparisons and Incrementum’s Gold Price Model indicating the metals’ bull market still has a considerable way to run.

The 443-page report subtitled ‘The Big Long’ says that run will be driven by factors such as looser monetary policies and the associated inflationary risks, tariff-abetted stagflation, simmering geopolitical tensions and underlying market dynamics.

Quo vadis?

The price forecasts are included in the chapter ‘Quo Vadis, Aurum?’, meaning ‘where are you going, gold?’ in Latin, spoken by ancient leaders who would buy a toga fit for the Roman Senate with an ounce of gold.

More recently, gold has doubled in US-dollar terms since January 2020 and added multiple all-time highs up to US$3,432 (A$5,330) this year. In a retreat over the past month it’s now trading at of US$3,316 or A$5,155 – which still buys a very fine suit for a modern-day senator.

The report says the setbacks of the past month are an integral part of bull markets, adding these drawdowns are opportunities for investors prepared to wait for the next uptrend.

The ‘Big Long’ also calls on investors to question their generally low gold allocation, saying the long-term inflation hedge is the ‘GOAT of the Portfolio’.

It points to the fact that central banks have put away more than 1,000 tonnes of bullion for the third consecutive year, with official reserves stacked at fresh records.

Those official net purchases outstripped production by 300 tonnes last year – and recycling is close to record highs of 1,370 tonnes.

Incrementum states that gap underscores why mine development matters more than ever.

Northern exposure

Getting ready to burst out of the blocks and face the forecast bull run head on is Nova Minerals, which is developing its Estelle gold and critical minerals project.

Estelle lies within Alaska’s Tintina Belt, a province with a documented gold endowment of more than 220 million ounces.

Nova Minerals’ (ASX:NVA) project has a global mineral resource estimate of 9.9Moz, making it one of the world’s largest undeveloped gold projects in a tier-1 jurisdiction, and there’s strong potential for it to join the exclusive 10Moz club.

The company is focused on engineering and optimisation studies at Estelle’s high-grade RPM deposit, which will go towards finalisation of the well underway pre-feasibility study.

All the required metallurgical studies, environmental test work, infrastructure permitting are also in progress.

Nova is also advancing a Korbel pit design which will be used to demonstrate the potential of an expanded project.

Also about to get underway during the northern field season is exploration to upgrade the MRE. Estelle hosts more than 20 prospects, including four large and shallow IRGS (intrusion related gold system) deposits, giving the drillers plenty of scope.

Nova is looking forward to seeing results following up on last year’s program that produced 20 broad intercepts of more than 5 grams per tonne (g/t) gold from close to surface, including one of 2m averaging 52.7g/t gold.

The team is also eagerly anticipating seeing the impact of a materially higher gold price in the upcoming studies.

A Phase 2 Scoping Study completed in 2023 included a net present value of US$654 million (A$1.02 billion), but that was based on a gold price of only US$1,850 (A$2,880).

The study’s sensitivity analysis also showed that at a US$1,980 (A$3,082) gold price – less than the current spot price and much lower than forecasts – the NPV rises to just shy of US$1 billion, at US$942 million (A$1.46 billion).

This article was developed in collaboration with Nova Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.