Everything you need to know before the ASX opens. Pic: Getty Images.

Good morning everyone and welcome to Rise and Shine on Friday, May 30, 2025. Here’s what you should know before the ASX opens today…

The ASX is looking a little unsteady heading into Friday’s session, with futures down 0.2% by 7am AEST.

It follows a choppy session on Wall Street, where a late rally fizzled out under the weight of tariff tension and patchy economic signals.

Wall Street can’t shake the tariff blues

Wall Street started strong, especially with Nvidia blasting out of the gate on another blowout quarter. At one point, the stock was up more than 5%, but by the close, it had cooled to a 3% gain.

The S&P 500 rose 0.4%, while the Nasdaq and Dow both scraped in modest lifts.

| STOCK INDICES | Value | Change |

| ASX 200 (previous day) | 8,410 | 0.15% |

| S&P 500 | 5,912 | 0.40% |

| Dow Jones | 42,216 | 0.28% |

| Nasdaq Comp | 19,176 | 0.39% |

| Euro Stoxx 50 | 5,371 | -0.14% |

| UK FTSE | 8,716 | -0.11% |

| German DAX | 23,933 | -0.44% |

| French CAC | 7,780 | -0.11% |

Still, traders weren’t exactly popping champagne. A combo of weak data of falling home sales and rising jobless claims, and more tariff turbulence saw bond yields fall and volatility creep back.

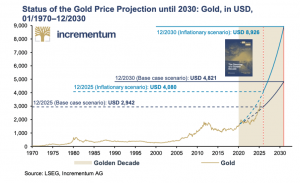

Investors scrambled into the safety of gold, and now expect the Fed to cut rates sooner rather than later with yields tumbling.

Trump’s tariff saga rolls on

Just as the courts told Trump he had overstepped with his global tariffs, a US appeals court stepped in with a temporary pause, letting the levies stay (for now).

The uncertainty is not great for companies with exposure to global supply chains, and traders are again being reminded how much politics can punch the market around.

Nerves around trade policy are likely to remain a feature, and for Aussie exporters and multinationals, that means more chop ahead.

Retail test for Aussie spenders

Back home, all eyes are on April retail sales at 11.30am AEST. NAB is tipping a 0.4% bump, slightly above last month’s 0.3% rise.

But with flooding and wild weather disrupting parts of the country, today’s figures could be a little messy.

The read will help shape the RBA’s view on demand, especially in the face of sticky inflation.

And tonight, the US drops its own PCE inflation data, another key piece in the Fed’s rate puzzle.

Commodity/forex/crypto market prices

| Price (US) | Move | |

| Gold: | $3,317.73 | 0.96% |

| Silver: | $33.31 | 1.04% |

| Iron ore: | $99.27 | -0.12% |

| Nickel: | $15,354.00 | 1.71% |

| Copper: | $9,292.80 | -0.26% |

| Zinc: | $2,674.75 | -0.52% |

| Lithium carbonate 99.5% Min China Spot: | $8,500.00 | -0.58% |

| Oil (WTI): | $60.92 | -1.49% |

| Oil (Brent): | $64.18 | -1.11% |

| AUD/USD: | $0.6450 | -0.30% |

| Bitcoin: | $106,246.73 | -1.20% |

What got you talking

Also in the news…

M&A fever has taken over the mining industry. Kristie Batten gives a whirlwind review of deals across gold, lithium, rare earths and copper.

Check out which Aussie tech stocks have been locking in government deals, which could mean steadier cash, stickier revenue, and less market mood swings.

Nero Resource Fund founder and co-portfolio manager Rusty Delroy brings us the latest Counter Cycle column, detailing his three mining picks.

Trading halts

Babylon Pump & Power (ASX:BPP) – potential acquisition and debt funding

CZR Resources (ASX:CZR) – general meeting re: asset disposal

EVE Health Group (ASX:EVE) – general meeting outcome pending

Firetail Resources (ASX:FTL) – potential material acquisition

Golden Horse Minerals (ASX:GHM) – cap raise

Green Critical Minerals (ASX:GCM) – cap raise

Locate Technologies (ASX:LOC) – cap raise

M3 Mining (ASX:M3M) – board update and requisitioned meeting

Metrics Master Income Trust (ASX:MXT) – cap raise

TruScreen Group (ASX:TRU) – pending announcement

Vinyl Group (ASX:VNL) – cleansing notice issue

Way2Vat (ASX:W2V) – cap raise

At Stockhead, we tell it like it is. While Nordic Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.