Funds-raise by BFSI companies via IPOs is expected to top ₹50,000 cr mark in FY26

| Photo Credit:

iStockphoto

A surge in initial public offers (IPOs) from companies in the BFSI (banking, financial services and insurance) space is expected in FY26, going by offer documents filed with SEBI.

According to market estimates, fund-raising via IPOs, which will include either fresh issuance of equity shares or offer for sale of equity shares or a combination of these two, by BFSI companies in the ongoing fiscal year, could easily top the ₹50,000 crore mark or more than three times the amount BFSI companies raised in FY25.

In FY25, eight companies in the BFSI space (against 10 in FY24) raised ₹16,275 crore via IPOs (₹9,655 crore), per primedatabase.com.

The surge in the BFSI sector IPOs is being driven by pure amalgamation of regulatory, market and business considerations, said Ajay Garg, CEO, SMC Global Securities.

BFSI firms

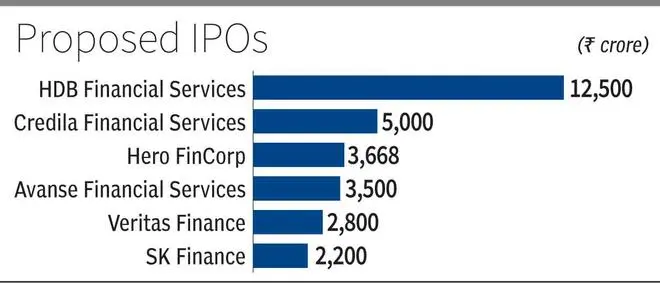

About a dozen-odd BFSI companies have lined up for tapping the equity capital markets in FY26. These include upper layer non-banking finance companies such as HDB Financial Services (about ₹12,500 crore) and Tata Capital, whose quantum of fund raise is not yet disclosed, but is expected to be in the region of $2 billion based on the trading of its unlisted shares.

Further, Avanse Financial Services (about ₹3,500 crore), Credila Financial Services (about ₹5,000 crore), Hero FinCorp (₹3,668 crore), SK Finance (₹2,200 crore), and Veritas Finance (₹2,800 crore), too, will be raising monies via equity issuance.

The other BFSI companies that are planning to tap the equity markets but have not yet disclosed the quantum they will be raising include Canara HSBC Life Insurance, Canara Robeco Asset Management Company, National Securities Depository Ltd (NSDL) and Groww.

Narendra Solanki, Head, Fundamental Research – Investment Services, Anand Rathi Shares and Stock Brokers, observed that after a long lull, the equity markets have bounced back 15-20 per cent from their low and this has bolstered the confidence of BFSI companies to take the IPO route for fund raising.

Incidentally, the funds raised through the IPO route will help the promoters, especially the banks, to tide over the liquidity crunch due to intense competition for fund raising via fixed deposits amid the early stage of rate cut cycle, he said.

“The IPOs from BFSI sector are expected to get good response from investors on the back of income tax cut announced in the Union Budget coming into force from April and early onset of rains amid hopes of normal monsoon.

“This will boost consumers income, which may partially flow into mutual funds via incremental Systematic Investment Plan, investment in IPOs and better spending during the forthcoming festival season,” opined Solanki.

SMC Global Securities’ Garg observed that many NBFCs, insurers and fintechs are tapping the primary market to raise growth capital, meet regulatory norms and diversify funding sources.

“Unlike banks, which have access to stable deposits, these entities often face higher borrowing costs from banks and bond markets, making equity a more attractive, long-term capital source,” he said.

Regulatory push

Garg emphasised that regulatory push from the RBI and IRDAI are also prompting large NBFCs and insurers to list, which will ensure greater transparency and governance.

Moreover, promoters of companies from these segments see IPOs as a strategic opportunity to reduce debt, fund expansion, and comply with enhanced capital adequacy norms.

However, the market is turning selective, with discerning institutional participation expected to drive demand.

More Like This

Published on May 28, 2025