One of the most important things an investor can do is run a diversified portfolio. But carefully hand-picking assets with the discipline and mindset of a long-term investor is easier said than done.

After all, investing requires time, planning, research and if you’re seeking personalised financial advice, maybe even a few additional costs.

Fortunately, today’s investors have access to a range of tools that makes smart investing more achievable than ever. One of those tools is one that has seen a rise in popularity among investors of all stripes – managed portfolios.

What kind of investor are you?

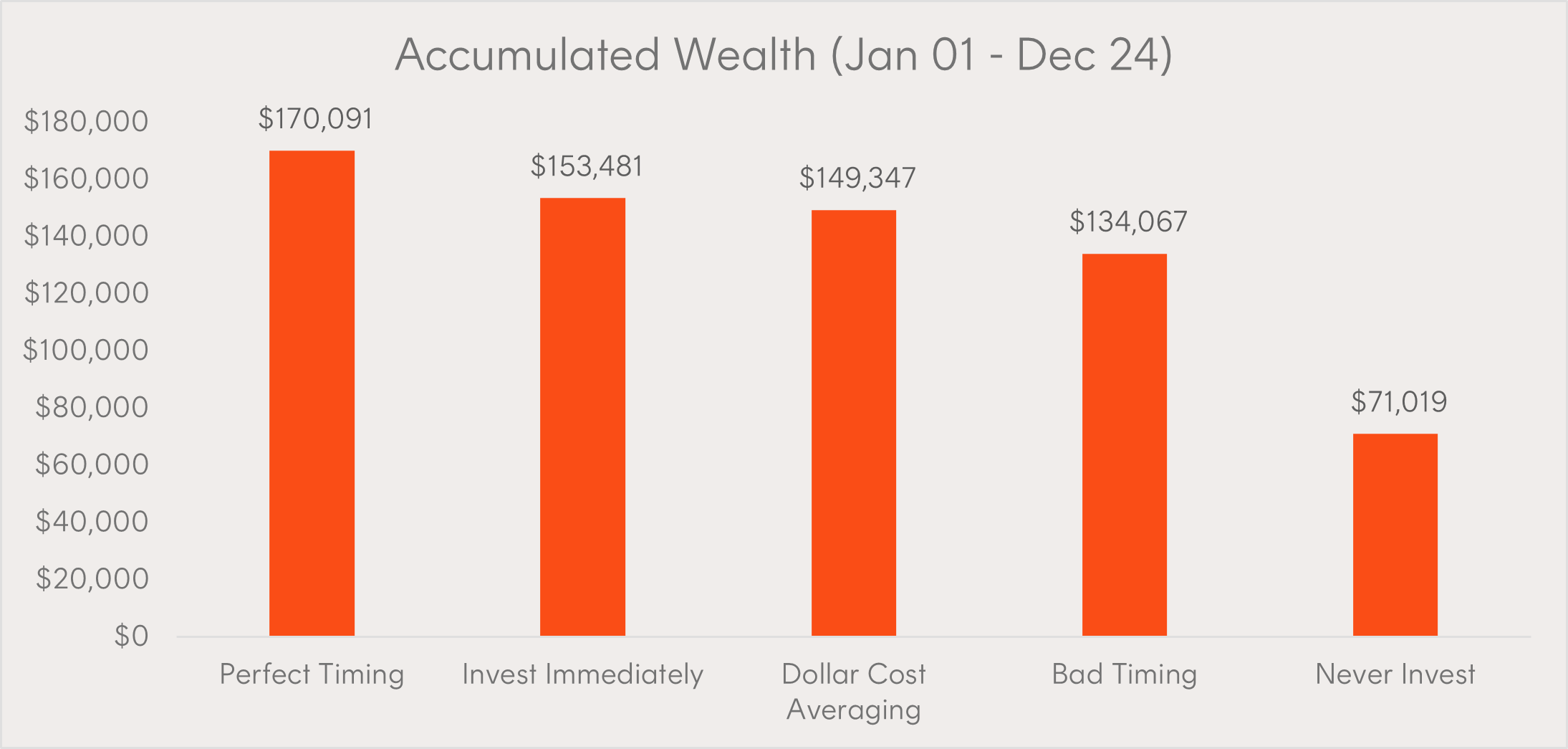

To bring this to life, let’s consider five hypothetical investors. Each of them will employ a very simplistic investment strategy inspired by a Charles Schwab study from 2020. It involves investing $2,000 every year in the ASX All Ordinaries Index over 24 years in five different ways:

- Lucky Leo: Always invested at the market’s lowest point each year

- Rapid Riley: Invested on the first day of the year

- Steady Eddy: Employed a dollar cost averaging strategy, investing in 12 equal monthly investments at the start of each calendar month

- Hopeless Harry: Always invested at the market’s highest point during the year

- Hesitant Haley: Never invested, stayed in cash.

Which of these hypothetical investors do you think would come out on top – and who would finish last? The chart below shows you the outcome:

For illustrative purposes only. Individuals invested $2,000 each year into a hypothetical portfolio that tracks the ASX All Ordinaries Accumulation Index. Results are as of the end of 2024. Does not take into account any fees and costs. You cannot invest directly in an index. For the purposes of this analysis, it is assumed that the individual who never invested (Hesitant Haley) received a return on their cash in line with Bloomberg Ausbond Bank Bill Index. Past performance is not indicative of future performance.

Unsurprisingly, Lucky Leo and his perfect market timing allow him to take top spot. However, this scenario is, at best, unrealistic. As this article explains, timing the market is a stressful exercise fraught with difficulties.

In contrast, Hesitant Haley records the lowest performance – but this isn’t surprising either, given an all-cash strategy tends to deliver a comparatively small return, particular over longer time periods.

What makes for a Haley?

Data collected by the ASX Australian Investor Study (2023) found that 27% of non-investors said they hadn’t started investing because they were not confident in making good decisions.

Among the non-investors in the study, this is the most commonly quoted reason for not investing, after not having enough money to start.

In addition, the data showed that more than half of all investors believe they are not well diversified.

While financial advice remains an invaluable resource for those who want tailored support, it’s not the only path forward. For investors seeking a simple, accessible way to build a diversified portfolio and stay invested over time, managed portfolios may be the right place to start.

So, what exactly are managed portfolios – and how do they work?

How do managed portfolios work?

Managed portfolios are a collection of assets managed on your behalf by investment professionals. The selection of assets, portfolio weightings, and rebalancing are all handled for you by a team of experts.

In Australia, the funds under management of managed portfolios have surged 146% between 2019 and 2024. This surge has primarily been led by financial advisers, but a range of firms, including Betashares, also offer managed portfolio options for retail investors. The rise in popularity can be attributed to the rise of technology, increased time and cost efficiencies as well as increasing demand for more ‘tailored’ investment solutions.

The Betashares Managed Portfolio range

Here at Betashares, we provide investors of all stripes with 10 managed portfolio options. Each one comes with all the benefits mentioned above plus the opportunity to check in on your portfolio at any time through the Betashares Direct platform.

Six managed portfolios for core exposure

The six ‘Core Portfolios’ range from a conservative option to an all growth option. They are differentiated by risk/return profile, allowing you to pick the investment option that works best for your objectives.

For instance, if you pick the conservative portfolio, 80% of your portfolio will be invested in ETFs providing exposure to defensive assets (such as fixed income or cash). Picking this option may suit investors with a low risk tolerance.

If you pick the high growth option on the other hand, 90% of your portfolio will be allocated toward ETFs that provide exposure to growth assets. Picking this option may suit investors with a higher risk tolerance and a longer-term time investment horizon.

Four focused portfolios for investment goals

In addition to the Core portfolios, there are four ‘focused exposure’ portfolios that have been designed for specific satellite exposures or investment goals. They are:

- B.EARN: A portfolio aiming to generate attractive and consistent income

- B.GREEN: A growth portfolio designed for ethically minded investors

- B.TECH: A portfolio focused on the technology sector and tech-driven industries

- B.GEAR: A ‘moderately geared’ portfolio strongly focused on capital growth.

Each is designed with different levels of risk tolerance and time horizons in mind, so may not be suitable to everyone.

Give your investing approach some peace of mind

Betashares Managed Portfolios offer a low-cost, automated way to work towards your investment goals.

Whether you’re a novice investor craving a strong foundation of investments or an experienced market observer who just wants to take the guesswork out of investing, Managed Portfolios may be a great way to leave the hard decisions to the experts.

You can find out more about Betashares Managed Portfolios here or on the Betashares Direct app.

References:

1. https://www.asx.com.au/investors/investment-tools-and-resources/australian-investor-study ↑

2. https://www.professionalplanner.com.au/2024/06/the-rise-and-rise-of-managed-accounts/ ↑

3. https://www.adviserratings.com.au/news/what-do-managed-accounts-and-taylor-swift-have-in-common/ ↑