Technology has rapidly advanced, making life more convenient. Combined with an increasing reliance on debt, it threatens Australia’s future, especially for the young. It’s time to get back to commonsense…

Who hasn’t heard the expression, “Money doesn’t grow on trees”?

Your parents may have said it to you when you were a child. And you may have done the same to your children too.

But working hard, saving up and living within your own means are no longer the way to help you get ahead. These days it’s about becoming an online influencer, borrowing to the hilt, and living a lifestyle to impress others, even if you can’t afford it.

How did we get ourselves into this mess?

The problem is that we’re living in a corrupt system. Think about the myriad scandals involving government officials, businesses, academic institutions, and the media’s role in covering up or censoring information.

We receive the wrong message about honour, virtues, wealth and spending. Our society is increasingly divided as family breakdowns, increasing resentment within the community continue to fester. Our younger generation is at risk of becoming apathetic, pursuing instant gratification and frivolity.

Our society pursues the expedient, rather than what comes with virtue and patience.

Financial innovation has reached such heights that you can now buy a pizza delivery with a ‘buy now, pay later’ arrangement. It allows you to pay off a $20 clothing item in instalments…

The government can send you cheques at whim, while banks are issuing credit cards and loans to those without a stable income (in some cases, even no income!). This has distorted the way we see money and wealth.

Many are financially illiterate, but they don’t care. That’s because money might not grow on trees, but there’s access to unlimited credit.

Someone will have to pay for all this in the end. It might be the taxpayer. Our government could soon bring sweeping changes in tax reform and redistribute wealth given that the Labor government has an overwhelming majority in the House of Representatives and the Labor-Greens now have a majority in the Senate.

A reckoning may be upon us. But what’s important is seeing through it to begin with and building the right foundation, for yourself and future generations.

Society today: More convenient, more opportunities and more indebted

We live in an era where technology is advancing rapidly. Information is available at our fingertips, making life more convenient.

The widespread availability of information and data has opened unprecedented opportunities for people to develop skills and knowledge.

Despite this, society seems to be going backwards in prosperity. We’re earning and spending more dollars, but we’re not getting wealthier. We’ve found more ways to spend wealth than to build it. Just look at the billboards when driving or walking down the streets. Someone is trying to sell you a lifestyle, product or image.

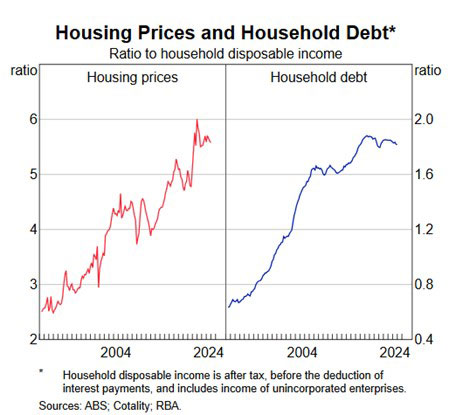

And if you don’t have enough to buy it, no problem, get it now and pay for it later. The average Australian’s housing and personal debt is much higher than our previous generations:

|

|

Wrong mindset, wrong priorities

You might understand that this is a problem. We get it. But we’re the minority. That’s why you’re reading this. You’re sick of the culture around us. What entertains many is the latest celebrity gossip, who’s attending the lavish parties, what they’re wearing, and who’s bought a waterfront pad, etc.

You probably even know friends or family who strive to live like these people, spending lavishly to emulate what they read. They may rack up bills and later lament to you about how life’s tough. Except it’s all their own doing.

What some people miss is that these rich people they read about are PAID and SPONSORED to flaunt their lives. Even if they aren’t, they’re selling their image and making their wealth from it. That’s them, it’s not for us.

The sad reality is many are conditioned by what they’re exposed to. The prevailing culture seeks pleasure, live for the moment, and chasing after frivolity. This has led to the wrong priorities, which is costly.

Pursuing financial literacy to restore the country

Call me idealistic, but I’d like to share with you my aspirations for what Australia could be. Something much more than what we are and where we’re heading.

Our forefathers settled this country almost 250 years ago. We’re blessed with a rich endowment of natural resources and a geographic location that affords us natural protection and preserve our peace.

We have squandered some of that accumulated wealth through carelessness and misguided lifestyles.

It’s difficult to go against the prevailing culture, but we must try.

Our younger generation is in dire need of financial literacy. They can learn to accumulate wealth without taking wild risk and avoiding the consumerist lifestyle that they see pop culture promote shamelessly.

Some are doing this because they lost hope of a stable future. They believe the property market has departed from the station, and only the debt bullet train can help them catch up. But they’re stuck with paying the piper if they take that train. They may have seen their parents bear that burden, even splitting their family when things got tough and they gave up on staying together.

Besides learning the dangers of debt and not spending beyond one’s means, there’s gold.

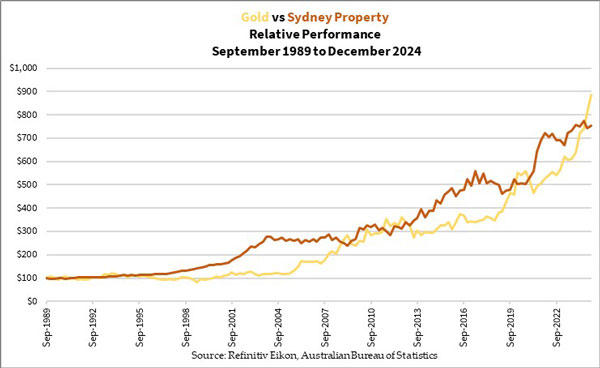

The asset that many experts derided as a ‘barbarous relic’ has emerged victorious against Australia’s most loved investment asset, real estate.

I’m not cherrypicking data from the last five years to make this bold claim. Let me show you 35 years of history, using our most prolific real estate market in Sydney:

|

|

It’s time to get back to the basics. Nothing tricky, just commonsense.

We need to learn the foundations of financial literacy to make Australia great again.

Start them young and ingrain the wisdom into them. They’ll be forever grateful to you.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Click here to watch now.

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

Brian Chu is one of Australia’s foremost independent authorities on gold and gold stocks, with a unique strategy for valuing big producers and highly speculative explorers. He established a private family fund that only invests in ASX-listed gold mining companies, possibly the only such fund in Australia, putting his strategy and research skills to the test under public scrutiny. He currently writes two gold-focused investment advisories.

In his Australian Gold Report, Brian shows you a strategy for building long-term wealth in physical gold, along with a select portfolio of hand-picked stocks, mainly producers with proven revenue streams, chosen for their balance of risk and reward.

In his more specialised Gold Stock Pro service, Brian helps readers trade some of the most exciting, speculative gold mining plays on the ASX. He uses his proprietary system — based on the famous Lassonde Curve model, which tracks the life cycle of mining stocks. His aim is to help you get ready to trade the next phase of gold and silver’s anticipated longer-term bull market for opportunities to benefit.