Investing in UK property can be simpler than you might imagine, and need less cash than you might think. I have a new, limited, option, at low prices.

It is clear that UK property remains one of the strongest asset classes for building serious wealth and enhancing your long-term savings and retirement plans.

Factors including the weak Pound, a robust legal system, demand far exceeding supply, and rising property and rental prices, along with ongoing infrastructure improvements in major cities and commuter towns demonstrate this.

Add in the growing population and you can see that this situation will not change, even with government support, as builders cannot keep up.

This shows that investing in UK property is a secure long-term investment – provided you get it right. That’s where I come in.

Not only can I advise on the best places to buy as an investment, I have the solutions and even a way of buying with a small deposit. While you usually need at least 25% of the purchase price, you can get started with much less.

I have previously written about options to invest in UK property that only need an initial deposit of 5% or 10% which is a great way to get on the property ladder without needing a large amount of cash.

Invest in UK property without a big deposit? Yes, you can!

What’s available?

A new development, with apartments at just £134,995. You only need an initial deposit of 10% being £13,399.

Upfront costs include legal fees of £999 and you pay the remaining deposit, a total of 25%, in 22 monthly instalments of £1,534.

The purchase price is fixed so you can even benefit from an uplift in value prior to competition in the last quarter of 2026.

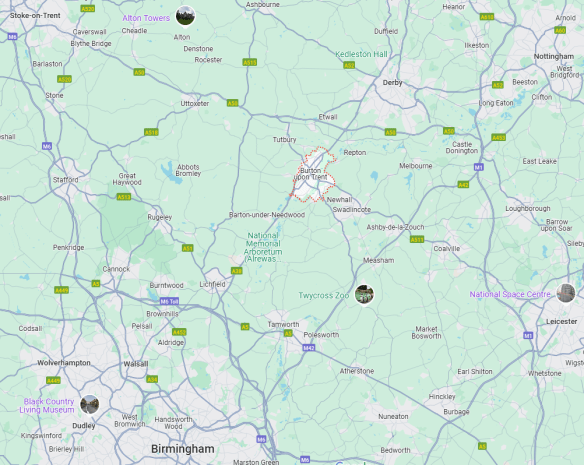

This is in the historic town of Burton upon Trent, recognised as one of the best towns to live in the UK.

This is in the historic town of Burton upon Trent, recognised as one of the best towns to live in the UK.

Known for its long history in the brewing trade, the town has a relatively young population with around half aged under 35 years. It is expected to see an increase in residents of 25% over the next 10 years.

There are a good number of local employers and in addition to eight local breweries, there are multiple manufacturers. The transport links are good with easy access to Birmingham, Tamworth, Wolverhampton, Leicester, Nottingham and Derby.

Did you know that the Marmite Food Company opened their original factory in Burton in 1902? It is still made there today, but is now owned by Unilever.

How does it work?

You pay the initial deposit and legal fees at outset, a total of £14,494.50

The first monthly payment is due soon afterward. An amount of £1,534.03

You then pay a monthly instalment, for the next 21 months, of £1,534.03

This allows you to pay a deposit of 25% over an extended period.

A few months before completion, you will be contacted to offer assistance with arranging a mortgage for the balance of purchase price.

During the first few months, the legal work will be undertaken and you will exchange contracts.

When you have made all the monthly payment and when the property is finished, you complete on the purchase, take out a mortgage, and start receiving rental income.

When you have made all the monthly payment and when the property is finished, you complete on the purchase, take out a mortgage, and start receiving rental income.

There will be some additional costs shortly before the finalisation of the purchase. These could be a small amount of further legal costs, a mortgage fee, and stamp duty (varies depending on your personal situation).

At this time, the estimated rental yield is 6.89%. This usually increases each year.

In all cases, my clients will get costs in writing, calculated for their personal situation.

The monthly instalments are equivalent to AED 7,002 per month. (Or SAR 7,160, QAR 6,950, OMR 735.)

How do I know where is best to invest?

We do the research so you don’t have to.

The value of property varies hugely across the UK, as does the rental income. What we need to consider is who is your target market as that is where you need to be investing.

We look at places with universities, many employers, improved infrastructure and amenities. Where there is a shortage of quality and affordable rental accommodation.

Naturally, prices are relevant not just as a purchase price but for potential growth and income. London is expensive and you can get better value for money, with lower overheads, by looking at other towns and cities, particularly in the midlands and north of England where there has been a great deal of government investment.

Remember that you are buying property as an investment – for rental income and capital growth – not to live in. This isn’t about where you might want to live but about where the most prospective tenants are, where you will see increasing rental income, and a return on capital.

Why the UK?

The UK has a mature and very secure property market. It doesn’t fluctuate wildly, build quality is high. All the legal protections are in place and with high demand and stability, you can invest with full confidence. The current level of demand for quality property is not going to reduce.

According to the UK’s Office of National Statistics (ONS): “Over the 15 years between mid-2021 and mid-2036, the UK population is projected to grow by 6.6 million people (9.9%) from an estimated 67.0 million to 73.7 million; this includes 541,000 more births than deaths, and net international migration of 6.1 million people.”

If you are earning in a currency pegged to the US Dollar, as you will be if living in the GCC (UAE, Saudia Arabia, Qatar, Oman, Bahrain, Kuwait), you can benefit from the weaker Pound and stronger US Dollar as you get more for your money. (There are 66 currencies pegged to the US Dollar.)

Many of the people reading this article will be British and intending to live in the UK in the future so an income in Sterling is a good plan. And while Sterling may be weaker now, it remains a major global currency.

More reasons in this article UK property investment. 10 reasons why it makes sense

Any other options?

There are always other options for UK property investment.

There are always other options for UK property investment.

If you need a mortgage, then as a UK non-resident you will require a deposit of at least 25-30% in most cases. If you want to invest with a deposit of just 5-10% options are fewer but I do have a few apartments in Birmingham at the moment

I also have a completed building in Nottingham that is for student accommodation The yield is good and an immediate return.

Just ask me for details.

This page on my website is updated regularly: UK property options. Latest info

** SPECIAL SHORT- TERM OFFER ** 10/05/25

If you are a freelancer in the UAE, or wider GCC, or own a business, it can be hard to get a mortgage to buy property even if you have a steady income but I have an answer for you.

You can buy this investment property without needing a mortgage.

You can start with a deposit of just 10%, pay the next 40% over a period of 14 months, at which time you complete the purchase with full legal ownership.

You then use the rental income to buy the rest of the apartment. Easy!

It’s open to anyone. No credit checks,

Does it sound too good to be true? I promise you it is genuine. It’s an amazing limited offer with no catch. See this video:

I can provide you with a financial statement showing how it works and more,. You also have the flexibility to overpay at any time.

Don’t hang about though as this offer won’t be around for long. The company is owned by one person who from time to time likes to offer something special. And you can benefit.

Further explanation here:

How do I find out more?

Get in touch! Click on this link to send me an email: keren@holbornassets.com

I have brochures, pricing schedules, all the information that you need to know.

We can calculate the amount of Stamp Duty payable on purchase based on your personal situation, potential mortgage costs and more.

We even arrange the life insurance and wills to protect your and the property.

We can have a relaxed and friendly chat without any obligation, and all initial meetings are over Zoom for maximum convenience.

To arrange a discussion about any aspect of your personal financial planning, please email me at keren@holbornassets.com

Expert, qualified, professional advice on a range of issues including general financial planning, life and critical illness cover, investments and UK pensions, wills and inheritance tax planning, UK tax, offshore banking, citizenship programmes, currency transfers and more.

I write articles such as this one as part of the holistic personal financial planning service and that I provide to expats, and the general consumer, financial and legal information that I provide in The National newspaper, other media, and on the Facebook group British Expats Dubai.

I write articles such as this one as part of the holistic personal financial planning service and that I provide to expats, and the general consumer, financial and legal information that I provide in The National newspaper, other media, and on the Facebook group British Expats Dubai.

Please take a look at the other useful articles on this website.

Currency transfers. Best rates and fully secure

Areas of advice. How can I assist?