In volatile markets, uncertainty often breeds hesitation. Over the past several months, we’ve received more questions about where to park cash than ever before—especially from retirees or those nearing retirement. You’re not alone if you’re feeling cautious or unsure. When everything feels expensive or unstable, keeping money in cash can seem like the only safe choice.

But let’s unpack this a little.

Is parking your cash the right long-term decision—or a temporary pause in a more important plan? Here’s how to approach it smartly, and where to put your money while you wait.

Why You Might Want to Park Cash

Parking cash usually stems from two situations. Either you’re nervous about market conditions and want to wait for clarity, or you’re retired (or approaching retirement) and want cash on hand for income stability.

In both cases, you are likely seeking investments with similar characteristics. You want your money to be easy to access, so liquidity is essential. You also want to ensure that your capital is protected—safety is non-negotiable. Stability is important too, because you don’t want to risk your cash reserve fluctuating in value. Finally, you’d prefer if your parked cash generated some kind of return while you wait for better opportunities.

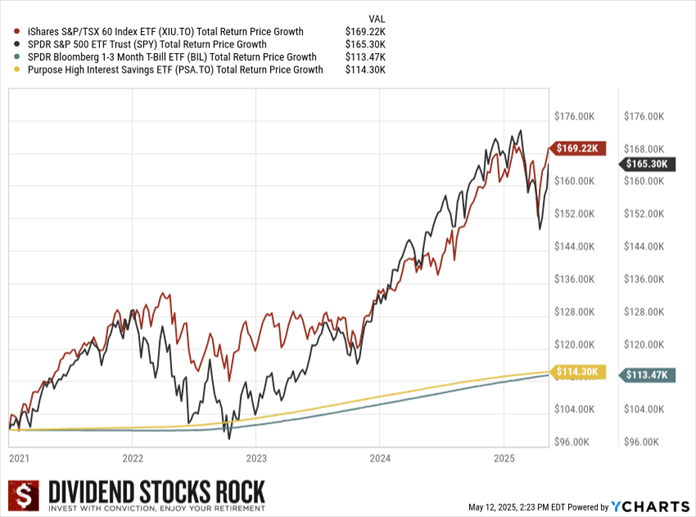

High-Interest Savings Accounts (HISAs), money market funds, and ultra-short bond ETFs generally meet these needs. But not all options are equal—and some come with hidden downsides.

What Most People Get Wrong About Parking Cash

Let’s start with an important truth: HISAs are commodities. Most of them offer the same basic benefits—safety, liquidity, and modest yield. Yet many investors obsess over finding the “best” rate.

Here’s the catch: the difference between a 3.89% and 4.16% yield on $100,000 is roughly $270 annually. After taxes, you’re looking at about $135. That’s hardly a game-changer for your financial future.

Despite this, many investors spend hours hunting for a few extra basis points in yield. That time would be better spent reviewing your investment plan or learning more about companies on your watchlist.

What often gets overlooked is that HISA returns are:

- Not tax-efficient in non-registered accounts.

- Often reduced once central banks start cutting interest rates.

- Poor at protecting against inflation over time.

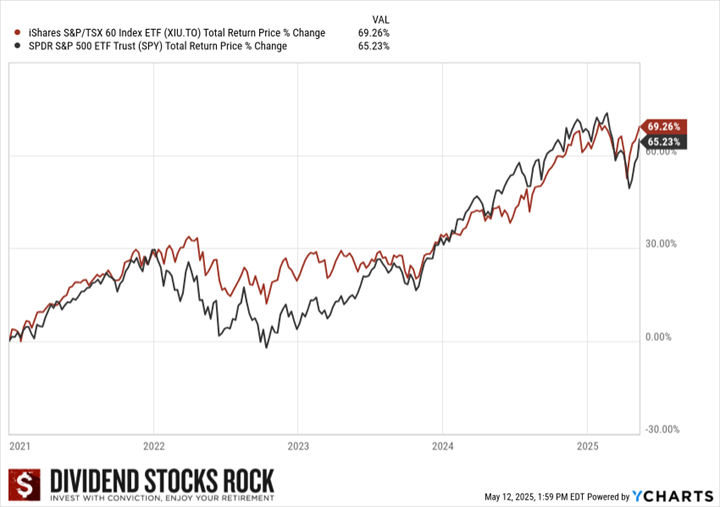

Worse, sitting on the sidelines waiting for the “right moment” to invest means exposing yourself to opportunity cost. Since January 2021, both U.S. and Canadian markets have climbed over 65%, despite endless headlines forecasting doom. If you stayed out of the market waiting for confirmation, you missed out.

A Better Reason to Park Cash: The Cash Wedge

If you’re retired, cash becomes more than a fear-based decision—it’s a strategic tool. That’s where the cash wedge concept comes in.

The idea is simple: during a market downturn, you use your cash reserve to fund your expenses instead of selling stocks at depressed prices. This buffer gives your portfolio time to recover, preserving your capital and dividend-paying stocks.

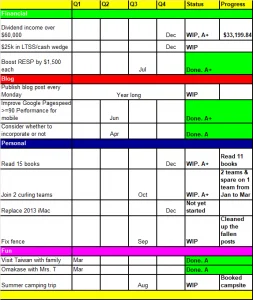

Here’s how to build your cash wedge:

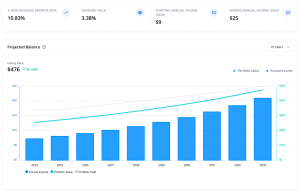

- Calculate how much income your portfolio generates annually (e.g., $1M at 3% = $30,000).

- Determine your annual retirement budget (e.g., $50,000).

- Find the shortfall ($20,000 in this case).

- Multiply that shortfall by three years = $60,000 cash wedge.

That $60,000 can sit in a HISA or money market ETF. It’s not about chasing the highest yield; it’s about providing peace of mind and flexibility.

Risks of Parking Too Much Cash

While having a cash wedge in retirement makes sense, overdoing it can lead to unintended consequences.

Key risks include:

- Erosion of purchasing power: Inflation silently reduces what your money can buy. For example, with a 4% HISA yield taxed at 40%, you net $2,400. But with 2.5% inflation, you’ll need $102,500 to maintain purchasing power. You actually lost $100.

- Falling interest rates: Today’s yields may not last. As rates decline, your return will likely shrink.

- No timing signals from the market: You’ll never get a perfect cue that it’s time to reinvest. Every year since 2021 has felt risky—and yet markets climbed.

- Opportunity cost: Parking $100,000 in cash instead of investing it in the market could have cost you $50,000 in gains over the past few years.

If you’re parking cash because you’re unsure, ask yourself: What would give me the conviction to reinvest?

How to Pick a Good Cash Option

If you’ve decided that a cash reserve is appropriate, don’t overcomplicate your selection process. Focus on the fundamentals.

Look for options that are:

- Liquid: You need to access funds quickly without penalties.

- Safe and stable: Stick with well-regarded banks or large ETF providers.

- Tax-efficient: In non-registered accounts, consider products like HSAV that reinvest income.

- Low-fee: A lower Management Expense Ratio (MER) improves net returns.

- Currency-aligned: Avoid USD options unless your spending is in U.S. dollars—currency swings can erase gains.

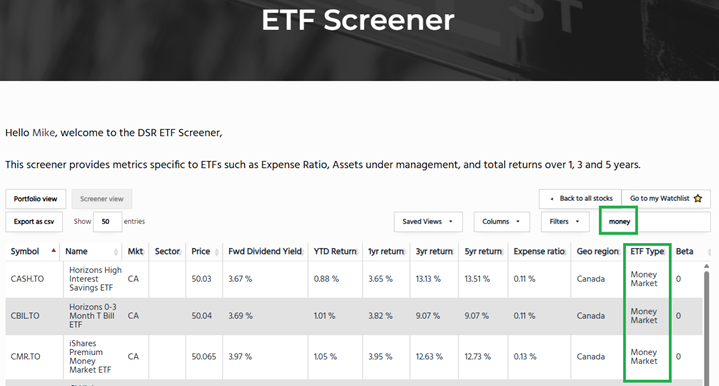

You can also use the DSR ETF stock screener or another ETF screener to find cash-equivalent ETFs. Simply search for keywords like “money” or “cash” and browse options in both CAD and USD.

Final Thoughts: Cash is a Tool, Not a Strategy

Cash has its place—but it shouldn’t be your plan. If you’re retired, a 3-year cash wedge makes sense. If you’re nervous, go back to your investment thesis and revisit why you invest in the first place.

Parking cash can be smart—but don’t let it become permanent.

Google+